us japan tax treaty article 17

Subject to the provisions of. He Double Tax Avoidance Agreement is a treaty that is signed by two countries.

Us Expat Taxes For Americans Living In Japan Bright Tax

The agreement is signed to make a country an attractive destination as well as to enable NRIs to take relief from having to pay taxes multiple times.

. Reach in Latin America article with image 348 PM UTC. Because residence is defined so broadly most treaties recognize that a person could meet the definition of residence in more than one jurisdiction ie dual residence and provide a tie. On or after January 1 of the year following the year in which the treaty enters into force.

Attachment for Limitation on Benefits Article. United States Mexico presidents summit snub shows limits of US. THE MULTILATERAL CONVENTION TO IMPLEMENT TAX TREATY RELATED MEASURES TO PREVENT BASE EROSION AND PROFIT SHIFTING.

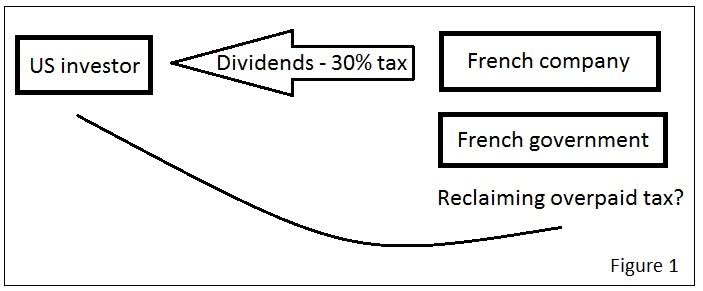

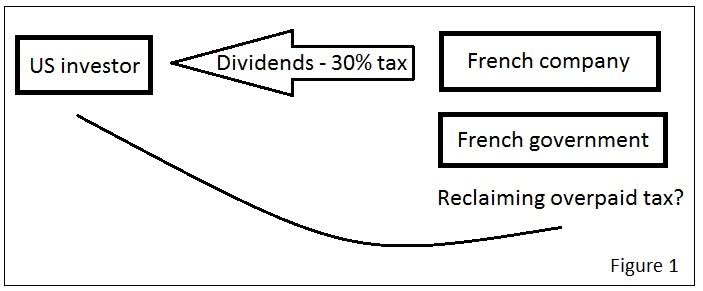

Form 17 - US PDF381KB Form 17 - UK applicable to payments made before December 31 2014 PDF399KB Form 17 - UK applicable to payments made on and after January 1 2015 PDF428KB Form 17 - France PDF421KB Form 17 - Australia PDF395KB Form 17 - Kingdom of the Netherlands PDF521KB. Articles 17 and 18 provide that under certain circumstances an individual who is a resident of one state shall be. For Japan dividends received from a more-than-50-percent-owned corporate subsidiary are exempt if certain conditions.

About Us History of Direct Taxation. The United States and Japan Tax Treaty Article Six VI refers to income generated from real property and basically provides that if a Resident of one of the states generates income from the other state then that other state may be able to tax the income. 165 Records Page of 17 in 0078 seconds TAX INFORMATION AND SERVICES.

The Kyoto Protocol was an international treaty which extended the 1992 United Nations Framework Convention on Climate Change UNFCCC that commits state parties to reduce greenhouse gas emissions based on the scientific consensus that part one global warming is occurring and part two that human-made CO 2 emissions are driving it. From tax by the other state. The industry leader for online information for tax accounting and.

May 17 2021 - 030207 PM. The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues. Article 28 also.

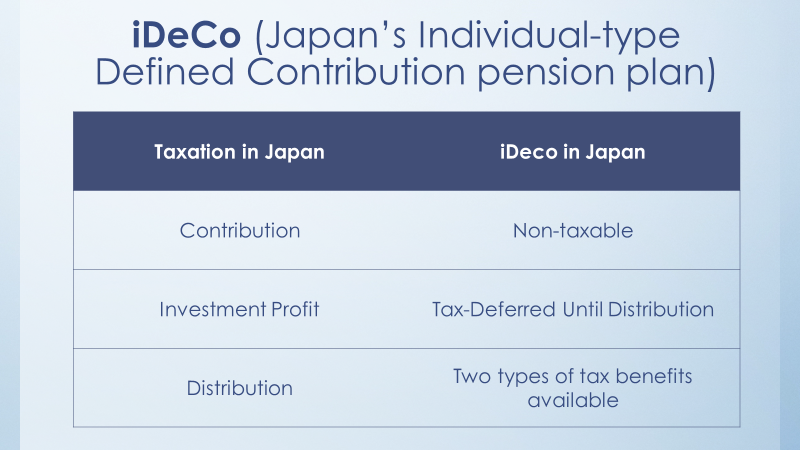

Article 17 Pension in the US Tax Treaty with Japan. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8. File Income Tax Return.

Federal Income Tax imposed by the. Summary of US tax treaty benefits. THE CONVENTION BETWEEN THE UNITED STATES OF AMERICA AND JAPAN FOR THE AVOIDANCE.

In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses. The United States includes citizens and green card holders wherever living as subject to taxation and therefore as residents for tax treaty purposes.

Us Expat Taxes For Americans Living In Japan Bright Tax

International Etfs The Hidden Cost You May Have Missed Nysearca Ewj Seeking Alpha

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

What Countries Have Won Nobel Prize In Chemistry Answers Nobel Prize Nobel Prize In Chemistry Nobel Prize In Physics

This Week In Tax Imf Pushes Japan To Raise Taxes International Tax Review

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

Form 8833 Tax Treaties Understanding Your Us Tax Return

Japan U S Relations Issues For Congress Everycrsreport Com

How To Fill Out Irs Form 8802 Us Residency Certificate Irs Forms Irs Internal Revenue Service

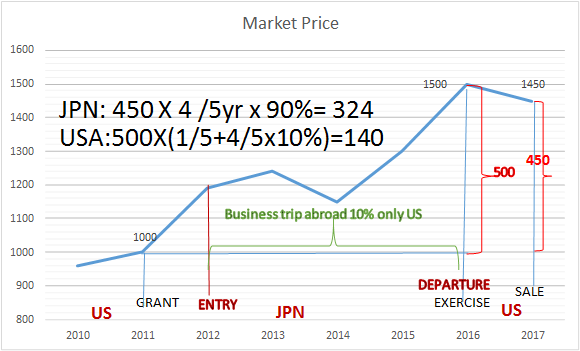

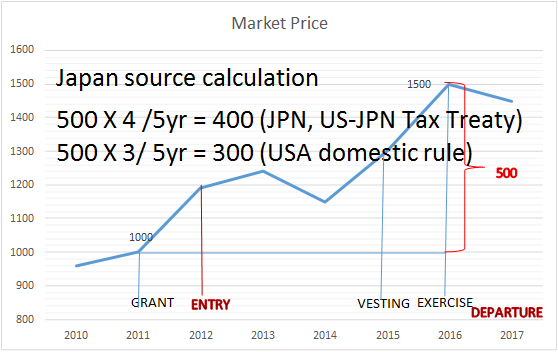

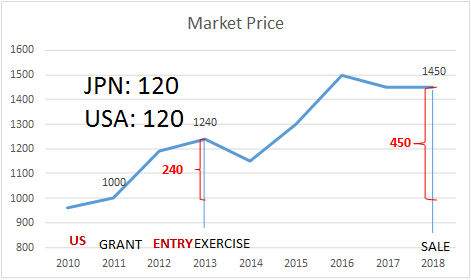

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Japan U S Relations Issues For Congress Everycrsreport Com

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Japan United States International Income Tax Treaty Explained

Us Ch Pension Plans And Treaty Benefits Kpmg Global

Japan United States International Income Tax Treaty Explained

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary